Blue-Ribbon-Committee’s-Assertion-on-Checkoff-Revenue-Questionable

Washington, DC In comments filed with the US Department of Agriculture regarding a revised proposal for a hardwood checkoff program, the original entity to request that USDA pursue the establishment of a checkoff program, the Blue Ribbon Committee, proposed yet a third plan. In its official comments, the group wrote:

… we believe further refinement is needed to reduce the scope of the program, simplify compliance, and strengthen support within the hardwood industry.

The BRC now proposes that green hardwood lumber and green air dried lumber be removed from the proposed definition of “hardwood lumber products” thus leaving only kiln dried lumber to bear assessments under the checkoff. The effect of this definition change, according to the BRC’s official comments to USDA would be,

The eligible class would be reduced from over a thousand mills to approximately 375 mills which have dry kilns or contract dry kiln capacity for sale of kiln-dried lumber, a more readily identifiable category of mills and more in keeping with the scale of the other forest industry checkoff programs.

According to the USDA, there are more than 2,800 hardwood manufacturers in the U.S., and under the BRC’s original proposal, more than 1,400 companies would have been eligible to vote in any referendum. The latest proposal to include only 375 eligible equates to 13 percent of the industry, which is, in fact, a far smaller percent of the industry than covered in other forest product checkoffs. Under the Softwood Lumber checkoff, the eligible class was 61 percent of producers, with those producing less than 15 million board feet exempt. Under the Paper and Paper Packing checkoff, the eligible class was about 67 percent, with those producing less than 100,000 short tons exempt.

Jeff Edwards, of Edwards Wood Products, and co-chairman of the US Hardwood Lumber Industry Coalition, responded to the BRC’s proposal, saying “it is quite telling that the BRC admitted to USDA that it is necessary to exclude 87 percent of all domestic hardwood manufacturers in order to ‘strengthen support’ for this – or any – checkoff proposal.”

Edwards continued, “the BRC clearly recognizes that the overwhelming majority of the hardwood industry does not want a checkoff program so the BRC’s strategy appears to be to push one through with the barest minimum of industry input and, then, once established, one can only assume there will be further attempts to pull in more of the industry to pay assessments.”

Indeed, in the original proposal published in the Federal Register nearly two years ago in November 2013, USDA’s Agricultural Marketing Service stated, “the BRC believes that $10 million in assessment income is the threshold for an effective program that could help to improve the market for covered hardwood.” In its latest comments, the BRC states:

We continue to believe ($10 million) is an appropriate amount …. The changes we are recommending would significantly reduce that amount, resulting in a roughly $3 to $4 million annual program. … A $3 million program would be a huge step for the hardwood industry

According to Jeff Hanks, of Bill Hanks Lumber, and co-chairman on the US Hardwood Lumber Industry Coalition, “while some may consider a checkoff with less than a third of its target revenue a ‘step’ in the right direction, it is, in fact, a huge leap to assume that the BRC’s latest proposal could even generate $3 million. In reality it will generate less than half that amount by our calculations.”

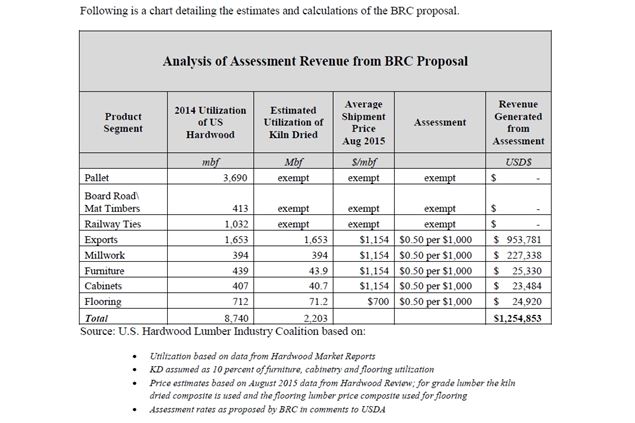

The U.S. Hardwood Lumber Industry Coalition conducted an analysis of the BRC latest plan. That analysis was presented at the Virginia Forest Products Association annual meeting held September 11-13 in Hot Springs, Virginia. According to the Coalition’s calculations, there’s likely to be an estimated 2.2 billion board feet of qualifying kiln dried lumber sold as exports and sold domestically for millwork, furniture, cabinetry, and flooring, which valued at average shipment prices from August 2015 and subject to a $0.50 per $1,000 assessment rate proposed by the BRC, would generate approximately $1.25 million in assessment revenue. This amount does not take into account the exemption for companies under the $2 million annual revenue threshold, nor the exclusion of Alder and Pacific Coast Maples as the BRC also requested in their comments.

Even assuming that all utilization of kiln dried hardwood lumber was subject to the BRC’s proposed assessment rate, and not taking into account the exemption for companies under the $2 million annual revenue threshold, nor the exclusion of Alder and Pacific Coast Maple, the BRC’s plan would raise only $1.9 million, still far short of their $3 to $4 million claim.

Hanks concluded, “A checkoff of $1.25 million isn’t enough to fund effective research, education and promote programs for the hardwood industry, but it is an expensive first step down a road toward a checkoff that the vast majority of the industry does not want to travel.”

THE CHART BELOW CONTAINS DETAILED ESTIMATES AND CALCULATIONS OF THE BRC PROPOSAL.

# # #

The US Hardwood Industry Coalition is comprised of hardwood lumber manufacturers nationwide who oppose USDA’s most recently published Checkoff proposal. In May of 2014, the Coalition commissioned a telephone research study about industry attitudes towards the Checkoff. Conquest Communications of Richmond, Virginia, questioned hardwood lumber manufacturers identified on a list from USDA of eligible companies to vote in any referendum on the Checkoff. A total of 257 companies responded. Those respondents represent 18 percent of the companies eligible to vote on USDA’s proposed checkoff, which is a statistically representative sample of all hardwood lumber manufacturers. When presented with the question, “as the USDA checkoff proposal is written, do you plan to vote for it or against it?” a total of 83 percent of respondents indicated they would vote against the checkoff program.

.gif)